業務内容 Works

当事務所では、税務の専門家である税理士と、法律の専門家である顧問弁護士が連携し、相続・遺言に関する業務を一括してサポートいたします。

特に、顧問弁護士が遺言執行者としての役割を担うことが可能なため、遺言の作成から執行、相続税申告までを一つの窓口で完結できる「ワンストップサービス」をご提供しております。

✅ ワンストップで対応できる業務内容

- 遺言書の作成支援(公正証書・自筆証書)

- 遺言執行者の就任と執行業務

- 相続税の試算・申告

- 相続人間の調整・法的助言

- 不動産・金融資産の名義変更手続き

煩雑になりがちな相続手続きを、税務と法律の両面からサポートすることで、安心・確実な相続を実現します。

🌸 ご家族の未来を見据えた、やさしい相続サポート

相続は、大切なご家族への想いを形にする大事な節目です。私たち税理士事務所では、一次相続だけでなく、その後に訪れる「二次相続」までを見据えた、丁寧なサポートを心がけています。

「将来、子どもたちに負担をかけたくない」「できるだけ円満に分けたい」そんなお気持ちに寄り添いながら、税金のことはもちろん、贈与や遺産分割の計画までしっかりとお手伝いします。

例えば、あるお客様は生前贈与を活用して、子どもたちへの相続税負担を大幅に軽減できました。また、遺言書の作成を顧問弁護士と連携してサポートし、ご家族間のトラブルを未然に防ぐことができました。

🍀 私たちが得意なこと

- ご家族の状況に合わせた、無理のない遺産分割のご提案

- 税理士と弁護士が連携することで、相続に関する手続きをワンストップで進めることができます。例えば、遺言書の作成から相続トラブルの未然防止、遺産分割の調整まで、専門家がしっかりとサポート。法律面の不安が軽減され、ご家族が安心して未来を迎えられるよう、心を込めてお手伝いさせていただきます。ご相談中に疑問や問題が生じても、すぐに弁護士が対応するため、スムーズで安心な手続きが実現します。

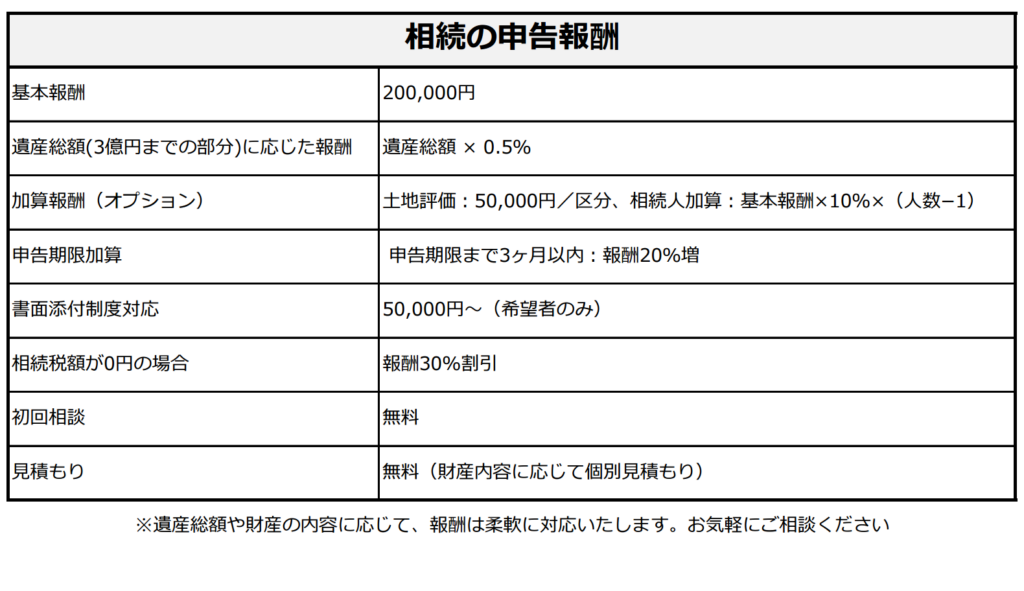

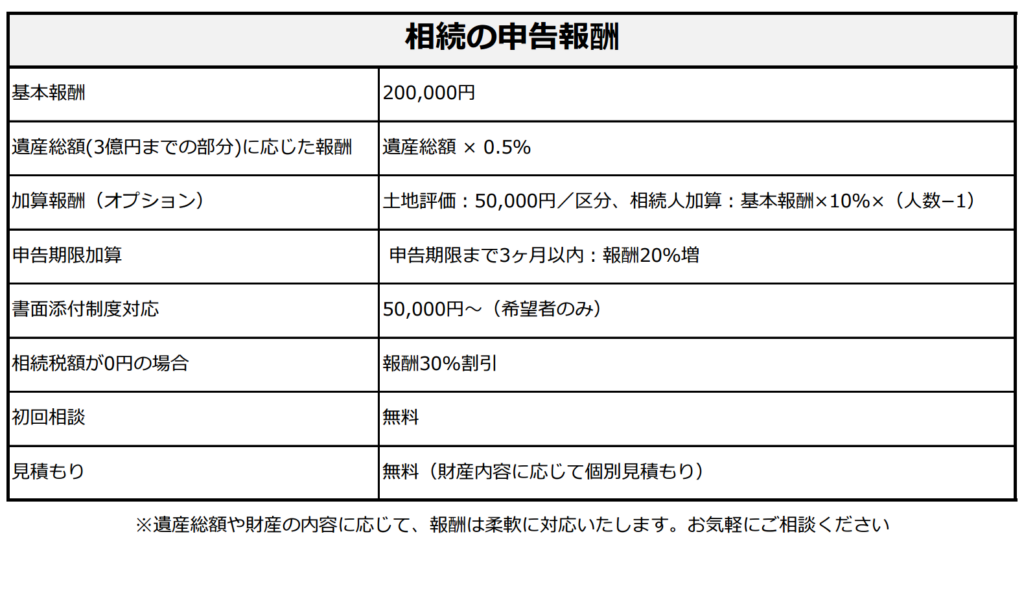

- 料金も良心的で、ご負担を抑えながら質の高いサービスを提供しています。安心してご相談いただける価格設定です。

税理士と弁護士が連携することで、相続に関する手続きをワンストップで進めることができます。

ご家族の未来が、安心で穏やかなものになるよう、心を込めてお手伝いさせていただきます。

1. 全体的な流れを示した、相続手続きのアドバイス

(a)戸籍謄本、不動産の固定資産税通知書等の必要書類の収集

(b)相続人の確定、相続財産の確定

(c)不動産の現地調査と土地の評価(特例適用判断)

(d)相続税額の試算

(e)遺産分割案の提示と遺産分割協議書の作成

(f)相続税申告書の提出

(g)相続税調査の立ち合い

2.顧問弁護士と連携し、公正証書遺言等の作成及び遺言執行

3.連携先の宅地建物取引業者や司法書士事務所と協力して、土地の売却と登記

4.日本国籍を有する方、日本国籍を有しない方

(非永住者及び、非永住者以外の居住者を含む)の確定申告

(国内所得だけでなく、国外における利子配当所得、不動産所得、給与所得等、

国外所得に係る外国税額控除額等を含む)

1.Advice on inheritance procedures, showing the overall process

(a) Collection of necessary documents such as family registers,

property tax notices for real estate, etc.

(b) Determination of heirs and inherited property

(c) On-site survey of real estate and evaluation of land

(determination of application of special provisions)

(d) Trial calculation of inheritance tax amount

(e) Presentation of the proposed division of the estate

and preparation of an estate division agreement

(f) Submission of inheritance tax return

(g) Attend inheritance tax inspections

2.Prepare and execute notarized wills, etc., in cooperation with our legal advisors

3.Selling and registering land in cooperation with the real estate agents

and judicial scrivener's office

4.Prepare tax returns for Japanese nationals and non-Japanese nationals

(including non-permanent residents and residents other than

non-permanent residents)including not only domestic income but also interest and

dividend income, real estate income, employment income, etc. outside Japan,

and foreign tax credits for income outside Japan.

1. 全体的な流れを示した、相続手続きのアドバイス

(a)戸籍謄本、不動産の固定資産税通知書等の

必要書類の収集

(b)相続人の確定、相続財産の確定

(c)不動産の現地調査と土地の評価(特例適用判断)

(d)相続税額の試算

(e)遺産分割案の提示と遺産分割協議書の作成

(f)相続税申告書の提出

(g)相続税調査の立ち合い

2.顧問弁護士と連携し、公正証書遺言等の作成

及び遺言執行

3.連携先の宅地建物取引業者や司法書士事務所と協力

して、土地の売却と登記

4.日本国籍を有する方、日本国籍を有しない方

(非永住者及び、非永住者以外の居住者を含む)

の確定申告(国内所得だけでなく、国外における

利子配当所得、不動産所得、給与所得等、国外所得

に係る外国税額控除額等を含む)

1.Advice on inheritance procedures,

showing the overall process

(a) Collection of necessary documents such as family

registers, property tax notices for real estate, etc.

(b) Determination of heirs and inherited property

(c) On-site survey of real estate and evaluation of land

(determination of application of special provisions)

(d) Trial calculation of inheritance tax amount

(e) Presentation of the proposed division of the estate

and preparation of an estate division agreement

(f) Submission of inheritance tax return

(g) Attend inheritance tax inspections

2.Prepare and execute notarized wills, etc.,

in cooperation with our legal advisors

3.Selling and registering land in cooperation with

the real estate agents and judicial scrivener's office

4.Prepare tax returns for Japanese nationals and

non-Japanese nationals (including non-permanent

residents and residents other than non-permanent

residents) including not only domestic income but also

interest and dividend income, real estate income,

employment income, etc. outside Japan, and

foreign tax credits for income outside Japan.